In the world of trading, your success isn't just measured by your winning trades, but by how well you protect your capital during losing ones. Risk management in trading is the cornerstone of longevity in financial markets, yet it's often overlooked by beginners who focus solely on entry points and profit targets. This comprehensive guide will equip you with proven strategies to safeguard your trading capital and build a sustainable approach to market participation.

What is Risk Management in Trading?

Risk management in trading refers to the systematic approach of identifying, assessing, and controlling potential losses in your trading activities. It's the process of implementing strategies and tools that help protect your trading capital from significant drawdowns while maximizing potential returns.

Effective risk management isn't about avoiding losses entirely—losses are an inevitable part of trading. Rather, it's about ensuring those losses remain manageable and don't jeopardize your ability to continue trading. As the saying goes: "Live to fight another day."

Why Risk Management in Trading Matters

The importance of risk management in trading cannot be overstated. Even the most accurate trading strategy will experience losing streaks. Without proper risk controls, these losing streaks can devastate your trading account. Consider these statistics:

- 40% of day traders quit within their first month due to significant losses

- Most professional traders risk only 1-2% of their capital per trade

- Traders with formal risk management plans statistically outperform those without

Key Insight: Risk management in trading isn't just about preventing losses—it's about creating a sustainable framework that allows you to weather market volatility while preserving your trading capital for future opportunities.

Core Principles of Risk Management in Trading

Successful risk management in trading is built on several fundamental principles that every trader should understand and implement:

1. Position Sizing: The Foundation of Risk Control

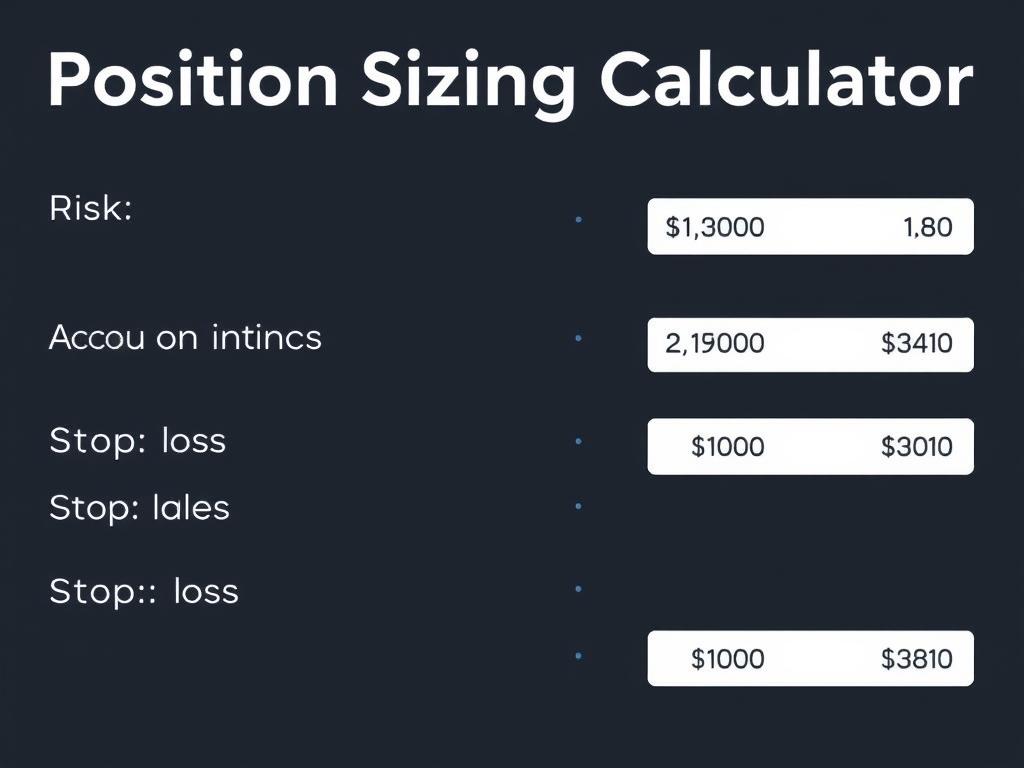

Position sizing determines how much of your capital you allocate to each trade. This single factor has more impact on your long-term results than almost any other aspect of trading.

Take Control of Your Position Sizing

Stop guessing how much to risk on each trade. Our free position size calculator helps you determine the exact position size based on your account balance and risk tolerance.

Get Your Position Size CalculatorThe 1% Rule: A Trader's Safety Net

The 1% rule states that you should never risk more than 1% of your trading capital on a single trade. This approach ensures that even a string of consecutive losses won't significantly deplete your account.

| Account Size | 1% Risk | 2% Risk | 5% Risk | Impact of 10 Consecutive Losses |

| $10,000 | $100 per trade | $200 per trade | $500 per trade | 1%: -9.6% | 2%: -18.3% | 5%: -40.1% |

| $25,000 | $250 per trade | $500 per trade | $1,250 per trade | 1%: -9.6% | 2%: -18.3% | 5%: -40.1% |

| $50,000 | $500 per trade | $1,000 per trade | $2,500 per trade | 1%: -9.6% | 2%: -18.3% | 5%: -40.1% |

2. Stop-Loss Orders: Your Trading Insurance Policy

A stop-loss order is an automated instruction to close your position when the market moves against you by a predetermined amount. This essential risk management tool limits your potential loss on any single trade.

Types of Stop-Loss Orders

Standard Stop-Loss

Closes your position at the best available market price once your specified price level is reached. Subject to slippage during volatile market conditions.

Guaranteed Stop-Loss

Guarantees execution at your specified price regardless of market volatility or gaps. Usually involves a small premium or wider spread.

Trailing Stop-Loss

Automatically adjusts as the market moves in your favor, locking in profits while still providing downside protection.

3. Diversification: Don't Put All Your Eggs in One Basket

Diversification involves spreading your trading capital across different markets, asset classes, and strategies. This approach reduces your exposure to any single risk factor and can help smooth your overall returns.

Effective Diversification Strategies:

- Trade multiple asset classes (forex, stocks, commodities)

- Use different timeframes for your analysis and trades

- Implement various trading strategies with different market condition requirements

- Balance correlated and non-correlated instruments

Warning: Over-diversification can dilute your focus and expertise. Start with a manageable number of markets and strategies, then expand gradually as your experience grows.

3 Powerful Risk Management Strategies for Traders

Let's explore three proven risk management strategies that can significantly improve your trading performance:

1. The 1% Rule: Capital Preservation in Action

We've mentioned the 1% rule earlier, but its importance warrants deeper exploration. This strategy limits your risk on any single trade to 1% of your total trading capital.

How to Implement the 1% Rule:

- Calculate 1% of your total trading capital (e.g., $10,000 × 0.01 = $100)

- Determine your stop-loss level in pips or points

- Calculate your position size to ensure your maximum loss equals your 1% risk amount

- Adjust your position size for each trade based on your stop-loss distance

"The 1% rule isn't just about limiting losses—it's about creating the psychological freedom to make objective trading decisions without the pressure of risking too much on any single trade."

2. Risk-Reward Ratio: Making the Math Work in Your Favor

The risk-reward ratio compares the amount you're risking on a trade to the potential profit. A favorable risk-reward ratio is a cornerstone of professional risk management in trading.

| Risk-Reward Ratio | Win Rate Needed for Breakeven | Profit with 50% Win Rate | Recommended For |

| 1:1 | 50% | 0 units | High-probability setups, scalping |

| 1:2 | 33.3% | 50 units | Balanced approach |

| 1:3 | 25% | 100 units | Trend following, breakout strategies |

| 1:5 | 16.7% | 200 units | Long-term position trading |

Pro Tip: A minimum risk-reward ratio of 1:2 is recommended for most trading strategies. This means your potential profit should be at least twice your potential loss on each trade.

3. Volatility-Based Position Sizing

Volatility-based position sizing adjusts your trade size based on current market volatility. This approach ensures you're taking appropriate risk regardless of market conditions.

Using the Average True Range (ATR) for Position Sizing:

- Measure current market volatility using the ATR indicator

- Determine your stop-loss distance in terms of ATR (e.g., 2 × ATR)

- Calculate your position size based on your risk amount and the ATR-based stop distance

- In more volatile markets, your position size will automatically decrease

- In less volatile markets, your position size will automatically increase

Master Volatility-Based Position Sizing

Our free ATR position sizing calculator helps you determine the optimal position size based on current market volatility, ensuring consistent risk management across different market conditions.

Download ATR CalculatorCreating Your Personalized Risk Management Plan

A comprehensive risk management plan is your trading blueprint that guides your decisions and protects your capital. Here's a step-by-step framework to create your own:

Step 1: Define Your Risk Tolerance

Your risk tolerance is highly personal and depends on factors like:

- Your financial situation and trading capital

- Your trading experience and knowledge

- Your psychological comfort with drawdowns

- Your trading goals and time horizon

Assessment Question: What percentage drawdown in your account would cause you significant emotional distress? This can help determine your true risk tolerance.

Step 2: Establish Position Sizing Rules

Document exactly how you'll determine position sizes for each trade:

- Maximum risk per trade (e.g., 1% of account)

- Maximum risk across all open positions (e.g., 5% of account)

- Position sizing method (fixed percentage, volatility-based, etc.)

- Adjustments for different market conditions or setups

Step 3: Define Your Stop-Loss Strategy

Document your approach to stop-loss placement:

- Technical stop-loss (based on support/resistance, chart patterns)

- Volatility-based stop-loss (using ATR or other volatility measures)

- Time-based stop-loss (exit if trade doesn't perform within a timeframe)

- When to use guaranteed stops vs. standard stops

Step 4: Set Risk Limits and Circuit Breakers

Establish rules that protect you from excessive losses:

- Daily loss limit (e.g., stop trading after losing 3% in a day)

- Weekly loss limit (e.g., reduce position size after losing 5% in a week)

- Monthly drawdown limit (e.g., take a break after a 10% monthly drawdown)

- Consecutive loss limit (e.g., pause after 3-5 consecutive losing trades)

Step 5: Document Your Risk Management Rules

Create a written document that includes all your risk management rules and keep it visible while trading. Review and update it regularly based on your results and changing market conditions.

Get Your Risk Management Plan Template

Don't start from scratch. Download our free risk management plan template, customizable to your trading style and risk tolerance.

Download Free TemplateThe Psychology of Risk Management in Trading

Effective risk management in trading isn't just about numbers and systems—it's also about managing your psychology and emotions.

Emotional Discipline: The Hidden Key to Risk Management

Even the best risk management system will fail if you don't have the discipline to follow it consistently. Emotional trading decisions often lead to abandoning risk management rules precisely when they're most needed.

Common Emotional Pitfalls:

- Fear: Taking profits too early or using stops that are too tight

- Greed: Not taking profits or moving stops further away

- Revenge: Increasing position size after losses to "win back" money

- Overconfidence: Ignoring risk management after a winning streak

"The market doesn't know who you are or how much you've lost. Revenge trading is like trying to punish the ocean for making you seasick."

Preventing Overtrading: Quality Over Quantity

Overtrading is a common risk management failure that occurs when traders take too many positions, often with inadequate analysis or outside their trading plan.

Signs You Might Be Overtrading:

- Trading out of boredom rather than because of valid setups

- Entering multiple positions in quick succession

- Frequently checking your positions and making adjustments

- Trading during your designated "no-trade" periods

- Feeling anxious when not in a trade

Psychological Hack: Keep a trading journal that records not just your trades but also your emotional state before, during, and after each trade. This helps identify patterns of emotional decision-making.

Real-World Examples: Risk Management Success and Failure

Learning from both successful and failed risk management scenarios can provide valuable insights for your own trading approach.

Case Study 1: Successful Risk Management During Market Crash

Trader Profile:

- Professional forex trader with 8 years experience

- Consistently risked 1% per trade

- Used volatility-based position sizing

- Maintained diversification across uncorrelated pairs

Outcome:

During the March 2020 market crash, this trader experienced only a 7% drawdown despite extreme market volatility. Their position sizing automatically adjusted to increased volatility, and diversification prevented correlated losses across positions.

Case Study 2: Risk Management Failure

Trader Profile:

- Retail trader with 2 years experience

- Initially used 2% risk per trade but increased to 5-10% after losses

- Removed stop-losses during drawdowns

- Concentrated positions in correlated instruments

Outcome:

After a series of losses, this trader abandoned their risk management rules and increased position sizes to "recover" losses. This led to a 60% drawdown within two weeks, followed by increasingly desperate trades that eventually depleted the account.

"The difference between successful and unsuccessful traders often isn't their entry strategy—it's their risk management approach when trades move against them."

Common Risk Management Mistakes to Avoid

Even with the best intentions, traders often make these common risk management mistakes:

1. Ignoring Market Conditions

Different market conditions require adjustments to your risk management approach. Volatile markets may require smaller position sizes, while trending markets might allow for trailing stops instead of fixed stops.

Signs You're Ignoring Market Conditions:

- Using the same position size regardless of volatility

- Not adjusting stop distances during news events

- Trading the same setup in all market environments

- Ignoring correlation risk during market-wide moves

Warning: Major news events and economic releases can cause extreme volatility and slippage. Consider reducing position sizes or staying out of the market entirely during these high-risk periods.

2. Revenge Trading After Losses

Revenge trading occurs when you try to quickly recover losses by taking larger positions or ignoring your trading plan. This emotional response almost always leads to even bigger losses.

How to Avoid Revenge Trading:

- Implement a "cooling-off period" after significant losses

- Have predetermined daily loss limits that force you to stop trading

- Focus on process over outcomes—a good trade can still lose money

- Keep a trading journal to identify emotional patterns

3. Inconsistent Application of Risk Rules

Many traders have solid risk management rules but apply them inconsistently. This selective application undermines the entire risk management system.

"Risk management isn't something you do when it's convenient—it's something you do consistently, especially when it's difficult."

Common Inconsistencies:

- Using proper position sizing for some trades but not others

- Setting stop-losses for some positions but not "sure things"

- Following risk rules during drawdowns but abandoning them during winning streaks

- Applying different risk standards to different markets or instruments

Conclusion: The Path to Sustainable Trading Success

Effective risk management in trading isn't just about avoiding losses—it's about creating a framework that allows you to participate in the markets sustainably over the long term. By implementing the strategies, tools, and psychological approaches outlined in this guide, you can significantly improve your trading performance and protect your hard-earned capital.

Remember that risk management in trading is not a one-time setup but an ongoing process that requires regular review and adjustment. Markets evolve, and your risk management approach should evolve with them.

Take Your Risk Management to the Next Level

Download our complete Risk Management Toolkit, including position size calculators, risk management plan templates, trading journal templates, and more.

Get Your Free Risk Management Toolkit